I just received Mario Boone's huge, 360-page full-color catalog for his auction, number 70 he will hold in Antwerp May 6 and 7, 2023. For the last forty years, Mario and his father Erik before him have been selling certificates from most countries across the globe. This catalog continues that tradition and I count about 140 lots related to railroads in North America plus a few coal companies.

I wanted to get notice out as quickly as possible, so have not had time to look closely at every lot, so let me hit the highlights.

The auction is divided into two parts, live and internet. The live auction sale contains the lion's share of scarce and rare certificates. Those items will cross the block May 6 and 7. The internet auction for the remained will take place on Invaluable.com on May 8 and 9.

Roughly half of the North American certificates are rarities and scarcities that are rarely seen for sale on either side of the Atlantic. Many of those are arguably unique. With the exception of one-of-a-kind proofs, I don't call any certificate "unique" because I do not know what hundreds or thousands of collectors may have hidden in their basements. But I can tell you, there are many items in this sale that I have only seen offered once.

Lot 687 is a March, 1832 (joint) stock certificate of the Delaware & Raritan Canal Co and the Camden & Amboy Railroad & Transportation Co. This was one of the earliest operations we can legitimately call a railroad, and this certificate was issued about six and half months before the line officially opened for traffic. It was issued to Robert Stevens and signed by Edwin Stevens as treasurer. (The certificate was cancelled with two pen marks and neither touch the signature.)

Another very early item, by California standards, is a $1,000 bond of the California Central Rail Road. This bond (#108) appears as lot 694 and is one of only two examples known to me. To my knowledge, this item was last sold by Scott Winslow in 1995 and has been hiding out in Germany since. Another example later appeared in Germany nine years ago.

Although issued three years after the previous bond, a very rare stock certificate from the Sacramento Valley Rail Road will be offered as lot 697. That company was incorporated in 1852 in California and ultimately became part of the Central Pacific in 1865.

Scarcer is lot 690 from the Chicago St Paul & Fond du Lac Railroad, dated1855. Its design is quintessential of certificates engraved by Wellstood Hay & Whiting. I have recorded only one occurrence of this variety of stock certificate offered in lot 690. I cannot find any record of other appearances before this item sold in a Fred Holabird auction in 2020.

Another serious rarity is an 1877 stock certificate from the Ralston Rail Road & Coal Co from here in Colorado. Ralston Creek was one of the first drainages prospected for gold by men heading to the California Gold Rush. They found only hints of gold there, but coal was later discovered at the base of the foothills and a railroad was planned to enable extraction. Mario is offering certificate #11, the only example I have encountered. It last sold in Germany in 2014.

Boone is also offering another equally rare stock certificate (lot 708) from the Alabama & Chattanooga Rail Road, dated 1871. I last encountered this single certificate (#41) in a 1997 Smythe sale.

Old Union Pacific Railway stock certificates are essentially unknown except in proof form. Lot 722 is a 50-share proof by American Bank Note Co and was dated 1881 in crayon pencil. These come up for sale only rarely and they are highly sought after.

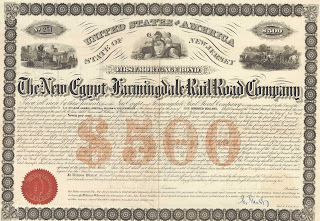

To save the best for last, I purposely skipped over eight lots (678 to 685) of Gould-signed certificates from seven different companies. We're not talking about the well-known and ever-popular items from the Missouri Kansas & Texas Railway. Gould's signature on seven of the eight lots are terribly hard to find and thus have starting prices in excess of 2,000 Euros. The standout, at a €12,000 minimum bid, is Gould's signature on an uncancelled $1,000 bond of the New Jersey Southern Railroad Company. Even the custom vignette on this bond is a keeper. I recorded this potentially unique bond from a Smythe sale in 1992 and it has been hiding somewhere for the last thirty-one years.

At more affordable levels are certificates from the second half of the sale offered to be over the internet on Invaluable.com. Most of those lots have starting bids in the range of €80 to €200, with a few cheaper and a few more expensive. While none are in the collectibility class of the live auction items, there are several notable scarcities waiting to be acquired by discerning intermediate to advanced collectors.

As always, I suggest two things. First, don't dawdle. Try to acquire a physical catalog while they are still available. At 360 pages, this is the largest Boone sale ever. Start by going to Booneshares.com.

The second thing I recommend is viewing items on Boone's site, even if you're going to bid on Invaluable. Mario has a new website design and his online catalog displays 100 items per page. Click on any item for a full description, and once there, click again on images to see scans larger than any of his competitors.

Again, please don't dawdle.