Several stock and bond collectors have told me they collect railroad magazines. About five years ago, I began compiling a database of information about

Railroad Magazine and

Trains Magazine, the two longest-running and most collectible consumer periodicals on railroading. I just finished adding that information to my web site at

Railroad magazines. (Or click on the menubar at Home > Other interests.)

Frank Munsey started

Railroad Man's Magazine in 1906 as an adjunct to his successful

Argosy Magazine.

Railroad Man's Magazine was a male-oriented "dime novel" (or novelette) monthly that told stories of high adventures and travails in railroading. Railroading had been a popular subject for story magazines since the late 1850s and it is somewhat curious that it took so long to start a dedicated publication on the subject.

Munsey's magazine was moderately successful and survived in monthly form for about thirteen years. Starting in December, 1918, the publisher tried a weekly schedule for the magazine and then tried a combination called

Argosy and Railroad Man's Magazine. The experiment does not seem to have worked and by May, 1919, the magazine reverted to independent form and monthly issuance.

Based on the numbers of issues I've encountered,

Railroad Man's Magazine must have had modest circulation. Nonetheless, it survived and ultimately changed its name to

Railroad Stories

Railroad Stories in February, 1932. Although the content did not change much, the covers of

Railroad Stories were much more intriguing and colorful than its predecessor. In fact, its covers were very much in the style of detective and true crime novels of the time. This move must have kicked sales, because many more issues of

Railroad Stories survive.

Like coal mining and other heavy industries, railroading had become much safer and more commoditized throughout the 1920s and 1930s. Fictional stories of train robberies, bridge collapses and fateful crashes became increasingly unrealistic and the desire for fiction gave way to a growing demand for factual articles about railroading. The magazine obviously recognized the trend and changed its name to

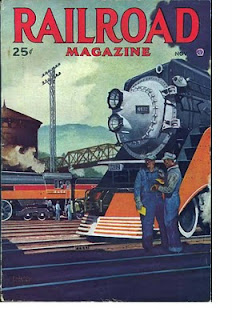

Railroad Magazine only five years later (September, 1937). While fictional stories and poetry continued to appear for many years, content eventually switched to real history and factual reportage by the 1940s.

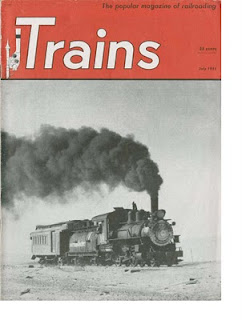

The demand for real facts was not lost on A.C. Kalmbach who had made a living reporting on and photographing real railroads. Kalmbach started

Trains Magazine in late 1940 and even went so far as to make the cut size of his monthly periodical almost identical to his long-running competitor.

Kalmbach's focus was strictly professional and factual. He chose coated paper over pulp and thereby gained the ability to offer higher quality photographs than

Railroad Magazine.

The heavy reliance on photographs and costly paper meant

Trains Magazine had a higher sticker price – 25¢ versus 15¢.

Trains had half the pages of

Railroad which meant its actual square-inch cost was almost four times higher.

While obviously covering the same subject,

Trains Magazine and

Railroad Magazine had noticeably different audiences. The differences are most noticeable in the designs of their covers and their advertising content.

Popular interest magazines of all descriptions began using photographs on their covers by the mid- to late 1930s. Except for a couple single-issue experiments (Nov, 1939 and Jun, 1954),

Railroad Magazine relied on custom art work for its covers until 1955. Many of its covers (especially in 1939) were purposely heroic and inspirational. Several covers drew on an earlier Art Deco styles (Apr, 1950) and a few were excellent derivitives of Frederic Remington's "nocturnes" (Aug, 1940, Mar, 1941, Nov, 1948) popularized four decades earlier.

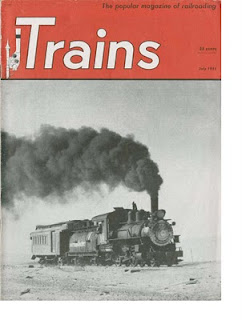

By comparison,

Trains Magazines relied on real black and white photographs from its very first issue in 1940.

Trains Magazine's photos, both inside and out, often bordered on "artsy," very much in the style of industrial-subject photos that appeared in

Life Magazine of the era (Nov, 1940, Dec, 1940, Dec, 1954.) While there may be more, I can only find one dedicated artwork cover (Nov , 1947). The least attractive covers appeared when

Trains Magazine experimented with strong graphics on its covers (May, 1954, Jul, 1955 and the abyssmally bad cover of Jul, 1959)

The two magazines also displayed obvious differences in advertising content. From its inaugural issue,

Railroad Magazine had always played to a popular consumer audience. Ads included the same ones that readers could find in practically any magazine: cigarettes, Mason shoes, promos for book collections of the classics, fishing lures, the Rosicrucians and get-rich-quick schemes. Trains Magazines tried to appeal to a more world-wise market and featured travel-oriented and image advertising by all the major railroads. The professional railroading aspect was played up with ads about freight movement, reliable wheel bearings, strong diesel power and dependable trucks.

While there are several other railroad magazines with collector interest, I have only collected information about these two classic magazines. I have recorded a few thousand sales of these magazines and show high, low and average prices when possible. I currently offer images of about 270

Railroad Magazine covers and roughly 180

Trains Magazine covers. That means I have a lot of room for improvement. I solicit any new images my readers may be able to supply. If someone might like to contribute information about other magazines (real railroads only), contact me and we'll discuss adding new pages.

Magazines dated after 1980 are usually worth much less than a dollar each, so that has always been my cut-off date. However, if any of you can supply images of

Railroad or

Trains magazine covers dated after that time, I will be glad to extend my date range.

Robert Schwartz and

Robert Schwartz and