WHEN in an article in our editorial columns we commented upon the lapse of time that had inter

vened since our city had been visited by anything like a genuine " sensation," it was not dreamt by us that even before that article should reach the eye of the public such an appalling tragedy would occur as that which, on the evening of January 6

th, produced an excite

ment in our midst rarely equaled by the simple announcement of the death of a single member of our vast community.

The facts connected with the tragedy; as far as we have been enabled to collate them from the most reliable sources, are as follows :

On the morning of Saturday, January 6th, a hearing had taken place at the Yorkville Police Court before Justice Bixby in the matter of the charge of libel prepared by Mrs. Helen Josephine Mansfield and Edward S. Stokes against risk. After the conclusion of the examination for the day, Stokes, accompanied by his counsel, Hon. John McKeon and Assistant District Attorney Fellows, repaired to Delmonico's, at the corner of Broadway and Chambers Street, and there partook of a lunch. While there, it is said, it was announced to Stokes that the Grand Jury had found an indictment against him for a conspiracy to extort money from Fisk. Immediately, upon hearing this, he left the party, but without making any remark which would lead any of those who were in his company to suppose that he was bent upon such a deed as assassinating a fellow-being.

Stokes, on leaving Delmonico's, at once proceeded to the Grand Central Hotel, where by some means he had ascertained Colonel Fisk was to call. He was observed by the attachés of the hotel lounging around the corridors and barroom of the place, apparently unconcerned and without any care. He seemed in good spirits, and noticed several acquaintances who met him there.

At a quarter past four Fisk drove up to the ladies' entrance, and stepping out of his car

riage, inquired of the door-boy, John Redmond, if Mrs. Morse and her daughter wore in. This Mrs. Morse is said to be the widow of the man who gave Colonel Fisk his first start in the world. The hall-boy answered that he thought Mrs. Morse and her eldest daughter had gone out, but that the younger Miss Morse was in her grandmother's room. Colonel Fisk requested the boy to show him up, and the two started, the colonel leading.

At that moment, and before Colonel Fisk had mounted more than two steps, Stokes suddenly made his appearance from some place of concealment, and a shot rang out, which struck Fisk in the abdomen, two inches to the right of the navel and three inches above it, passing downward, backward, and to the left, inflicting a terrible wound. Fisk fell, shouting, " Oh !" and immediately scrambled to his feet again, when Stokes once more leveled his revolver and fired another shot, the ball passing through and out of Fisk's left arm without touching the bone. The latter turned to run, but fell a second time, and slid down to the bottom of the stairs, where he was picked up by the crowd, who had gathered on hearing the report of the pistol, and carried up-stairs to an adjoining rum, where he was laid upon the bed, and the house physicians summoned. Stokes appears to have made little, if any, attempt at escape, but walked quietly downstairs through the main public staircase, and was about leaving the hotel by the rear entrance when he was stopped by Mr. Powers, the hotel proprietor, and some of his employes. The pistol (a four-barreled one) with which the deed was done was shortly after found, with two chambers discharged, under one of the lounges in the ladies' parlor, where it had evidently been thrown by the assassin before descending the stairs.

The police were summoned, and upon their arrival Stokes quietly submitted to arrest, and was escorted to the Mercer Street station, where he was detained until the arrival of the coroner, who, about half-past six, repaired to the hotel, and there, having impanneled a jury, proceeded to take the ante-mortem deposition of the victim. Upon Stokes being brought before him, Colonel Fisk fully identified him as the person who had fired the shots.

Dr. Tripler, the hotel surgeon, was in Fisk's room within a few minutes of the shooting, and probed the wound in the abdomen without success, for the purpose of finding the ball. He made him as comfortable as possible, and awaited the arrival of the other surgeons, who had been sent for before proceeding further.

Soon after this Police Surgeon Beach made his appearance, quickly followed by Drs. Sayre, White, Folsom and Wood. Upon the arrival of Dr. Wood a consultation immediately took place, when it was decided to hold an examination, and extract the ball, if possible. Jay Gould, James Irving, William M. Tweed, John Chamberlain, Jay Gould's clerk, Mrs. and the two Misses Morse, Colonel Hooper and wife, Colonel Fisk's brother-in-law and sister, and several other relatives, were present, having come in response to telegrams stating the colonel a condition.

At about seven o'clock his counsel, Mr. Shearman, who had been sent for, proceeded to draw his will, which was soon accomplished, and the document was signed by Fisk in a firm and distinct band. It has since been announced, that by this will he leaves all his property to his wife, subject to a legacy to his sister, Mrs. Hooker, of $100,000 ; an annuity of $3,000 for the support of his father and mother, and annuities of $2,000 each in favor of the two Misses Morse, until their marriage.

The surgeons were obliged to administer chloroform before they could proceed with the examination. The hole was large enough to have been made by a minie ball. Very little hemorrhage was found, and it was therefore concluded that none of the large vessels had been penetrated. It was feared, however, that the ball had gone through the liver, which lies in a direct line with its course through the body. At eleven o'clock the physicians held a consultation. Dr. Carnochan was called in to assist. It was decided that nothing more could be done for Mr. Fisk until Sunday morning, and as he was doing at the time remarkably well, no attempt to extract the ball was made.

The night dragged wearily its slow hours along at the hotel, while the watchers in the room where Fisk was lying, disregarding the faint lightening of the approaching dawn, waited with intense anxiety in the short spaces that elapsed between each opinion given by the attending physicians about his condition. The circle of thoughtful faces looked at times strangely wan and haggard, as the features, relaxed in involuntary forgetfulness, betrayed truly the nature of the thoughts that were driving one another through each brain. For, despite the common expectancy and the commoner hope that death would not at least come very speedily, a foreboding, inexplicable but not less depressing, seemed to have settled upon all. This could not have been from any betrayal of feeling by the medical attendants, for their faces wore studiously cheerful looks, especially whenever the prostrate man showed any signs of consciousness of his surroundings.

At seven o'clock Sunday morning, it was announced that he was fast sinking, and that the danger of a sudden ending of his intense agony was very great. His pulse was at this time 130. Dr. Fisher went down-stairs in a hurried manner and asked something of the night clerk ; then went back again. He looked very anxious.

Immediately after this, when the hand of the clock pointed a quarter after seven, a carriage driven very rapidly, the horses, wet and dappled with the foam that flew from their nostrils and congealed in the cold air, stopped short at the door. The coachman sprang from his perch, pulled open the door and helped out a lady in a dark traveling-dress, who stepped wearily to the ground. She walked quickly into the portico. This was Mrs. Fisk. She bad come from Massachusetts, in obedience to a telegram from her husband, announcing his condition. She displayed great agitation and distress upon reaching his bedside. He continued to sink gradually, remaining in an almost unconscious state until about eleven o'clock in the morning, when, in spite of all that medical skill could accomplish, the irrevocable summons came, and he who on the previous afternoon had been in the full enjoyment of life and health, was now a lifeless corpse, surrounded by a band of mourning relatives and friends.

At two o'clock in the afternoon the body was placed in a casket, and borne in a hearse from the hotel to Mr. Fisk's late residence on Twenty-third Street, in the rear of the Grand Opera House ; there the remains were placed in an ice casket in Mrs. Fisk's private chamber.

Visitors began to pour in, and Twenty-third street, in front of the house, was almost blocked with carriages.

The post-mortem examination of the body was held on Sunday night at half-past nine o'clock, at his late residence in Twenty-third Street. Drs. Janeway and Marsh conducted the examination. Drs. Wood, Sayre, White, Phelps, Tripler and Fisher, with Deputy-Coroners Beach, Marsh and Shine, were also present to assist if necessary. The result of the examination, which was somewhat lengthy, was, first : The wound in the left arm was a flesh wound, the ball passing directly through the arm, entering one inch below the elbow-joint, passing through the inner border of the biceps muscle, and making its exit through the posterior aspect of the arm. The fatal wound in the abdomen entered six inches above the umbilicus, and one inch and a half to the right of the median line, passed downward into the left through the omentum and mesentery, piercing two loops of the small intestine, and was found in the left inguinal region, about twenty-two inches below the point of entrance.

There was little or no hemorrhage. All the organs were examined, and the brain, the heart and the kidneys being found in a very healthy condition. A great deal of fat was observed in the omentum and parietes of the abdomen. The examination was concluded at half-past ten.

The funeral obsequies in the city took place on Monday, the 8th inst. The remains reposed in the entrance-hall on the west floor of the Erie building at 11 o'clock. The casket was appropriately decked with wreaths, crosses and cut flowers. All persons were admitted to see the body.

At half-past one o'clock the remains were escorted by the Ninth and other regiments to the New Haven Depot. Thence the cars bore the body away to the quiet New England town of Brattleboro', Vt., where it will be interred.

Short funeral ceremonies were held at Colonel Fisk's residence in Twenty-third Street. The Rev. Dr. Flagg, chaplain of the Ninth Regiment, officiated. The remains were forwarded by the New Haven Railroad.

The Grand Opera House was closed Monday evening.

Shortly after nine o'clock Sunday morning a carriage drove up to the Tombs entrance on Franklin Street. From it alighted Captain Burns, of the Mercer Street police, Stokes, the murderer, and two officers. Stokes looked nervous and sorrow-stricken, but he assumed an air of indifference as he passed the portal of the prison. He said to Captain Burns : " It's just about a year since I've been in this office." The prison being quite full, Stokes was confined temporarily in the same cell with Haggerty, who is charged with stealing the city vouchers. He is said to have expressed to Haggerty a confident expectation that he would be out in a few weeks ; but this remark, if made at all, was probably before he had been informed of the fatal result.

(The text below the woodcut does not indicate who the people watching over Fisk's death bed may have been. The woman on her knees weeping was almost certainly his wife. I strongly suspect the beaded man standing a few feet right of the bed was Jay Gould.)

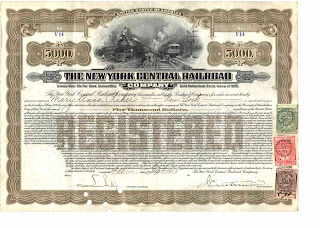

The latest full-color issue of Scripophily arrived a couple days ago. (See my announcement about the August issue for more information on supporting the International Bond and Share Society.) As before, I ask you to join me in supporting this organization which is now almost 42 years old.

The latest full-color issue of Scripophily arrived a couple days ago. (See my announcement about the August issue for more information on supporting the International Bond and Share Society.) As before, I ask you to join me in supporting this organization which is now almost 42 years old.

At a quarter past four Fisk drove up to the ladies' entrance, and stepping out of his car

At a quarter past four Fisk drove up to the ladies' entrance, and stepping out of his car