I record sales of railroad certificates every day, so I cannot help but notice price trends. While my database holds all sales prices, I still maintain a couple of special database fields where I manually track high and low prices. Yes, the database can always tell me those same record prices. However, manually recording new high and low prices lets me

feel trends continually.

Sadly, I record twenty to thirty new record low prices for every new record high. In doing so, that gives me a very, very good feel for the direction of the market. Thankfully, it seems I am recording fewer and fewer record lows than I did in 2008 and 2009.

Having said that, I am still encountering extremely few new high prices. Generally, new highs appear only when there are new discoveries. (And there are more new discoveries than average collectors realize.)

While being close to prices on a daily basis certainly gives me a

gut feel for the direction of the market, feelings can always be wrong. Feelings need confirmation. That can be gained only by stepping back and looking at prices in a more global manner.

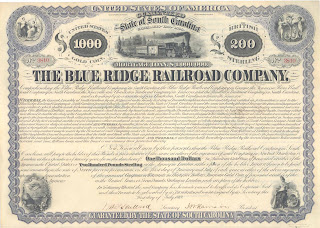

A few years ago, I established my “market basket” price index to help clarify how the market was numerically behaving. My index tracks 43 certificate varieties that seem to be in the

middle of the market. By that I mean that I used the database to identify railroad certificates that are neither too common nor too scarce and that typically sell a few times per year. By using a market basket of certificates, we can decrease the effects of sudden and unpredictable pricing quirks that can sometimes result from causes that have nothing to do with collecting, condition or rarity.

Yes, a typical collector who really wants to buy all 43 certificates would certainly stumble across some abnormally good deals in the process. On the other hand, that same collector would definitely make a few bad deals, too. Therefore, I decided to smooth out weird and non-rational price swings by basing index prices on averages of the last five sales prices for every certificate. I have a

Price Index page on my web site that explains the rationale in more detail. That page also links to another that displays

images of all 43 varieties.

Compared to the coin and stamp hobbies, our hobby is typified by very, very scarce collectibles. Market basket certificates are sufficiently scarce and sales sufficiently infrequent that I feel I can legitimately update the index only every six to twelve months.

By January, I will have thirteen full years of year-end prices. A few days ago, I updated the price index just to see where the market currently stands. As of this writing, the market is down 38% from its high in 2003.

Please understand that I do

not like this price trend in the slightest. Oh sure, I know many advanced collectors are happy that they can get screaming deals on scarce and rare certificates. I understand. I really do! But I must warn them to temper their elation with the understanding that when it comes time for older collectors to sell, they are going to be selling into that very same, weakened market.

Dealers and collectors who think prices are still as high as they were in 2003 are seriously mistaken.

Few market watchers have crystal balls and all of their devices are very cloudy. No one knows when the market for collectible certificates is going to turn around. I

genuinely hope it is tomorrow!

However, even if the market for railroad stocks and bonds turns around in the next 24 hours, I cannot help but wonder long will it take before prices recover to 2003 levels.

Experienced observers know that typical market recovery takes substantially longer than periods of decline.

I hope our hobby is atypical.

Bob Schell's 2012 Northern Virginia Stock & Bond Show will take place at the Crowne Plaza Hotel-Dulles Airport next January 27 and 28. This will be Bob's 11th, well-respected show at this location. Prices will remain stable for dealers and collectors setting up tables. Admission to the show for collectors is $3.

Bob Schell's 2012 Northern Virginia Stock & Bond Show will take place at the Crowne Plaza Hotel-Dulles Airport next January 27 and 28. This will be Bob's 11th, well-respected show at this location. Prices will remain stable for dealers and collectors setting up tables. Admission to the show for collectors is $3.